Boarding Merchants in the Portal

This guide demonstrates how to create a new merchant within the Payrix Portal dashboard manually using the Merchant Boarding Form.

Overview

From the Portal Dashboard, a Merchant can be boarded using the Merchant Boarding Form by selecting Merchants > Add Merchant on the Management menu.

-20220602-161903.png?inst-v=7eefa261-c42a-483d-8674-4322a282350d)

See the steps below to learn how to find and use the Merchant Boarding Form to board new merchants to the platform.

Merchant Boarding Form

Step 1: About the Business

The first step of the Merchant Boarding form is to provide information about the prospective merchant’s business. See the full list of requirements below.

Field | Required | Description |

|---|---|---|

Business Type | Required | Indicates whether a business is publicly or privately held. 0 = Private

1 = Public

|

Legal Business Name | Required | The full legal name of the business as registered with the IRS. |

DBA - Statement Descriptor | Optional | Defines how the merchant's business name will appear on the customer credit card statements. (If no descriptor is set, then this will display the Legal Business Name):

If a descriptor is defined, the box adjacent to this field will preview the Merchant's business name as it will appear on the cardholder’s statements. |

Tax ID Number | Required* | A 9-digit business identification code as issues by the IRS. *If the business is a sole proprietorship and no EIN was issued, enter the primary owner’s Social Security number (SSN). |

Years in Business | Required | The number of years that the merchant has been in business. |

Website | Required | The merchant’s public website where sales are run. If the merchant has no website (such as a brick and mortar only business), then enter https://nowebsite.com in this field. |

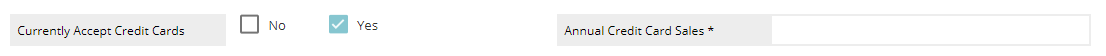

Currently Accept Credit Cards | Optional Default is no | An On/Off toggle to specify if the merchant currently accepts credit cards. |

Annual Credit Card Sales* | Required *Displays when Currently Accept Credit Cards is set to Yes | The current number of annual credit card sales for the merchant. |

| ||

Business Phone | Required | The business phone number to be stored on file. |

Customer Service Phone | Optional | The phone number that will show on the customer’s statement. If no customer service phone number is provided, the business phone number on file will be displayed. |

Fax | Optional | The merchant's fax number (if available). |

Address, Address 2, City, State, Zip | Required | The merchant's street address that is used on their tax form. PO Boxes are not allowed. *The merchant time zone is automatically set based on the location of the business’s address. |

Required | The merchant’s business email address used for electronic communication. *Owner's personal address (if different from business email) should not be used. | |

Step 2: About the Owner

The second step of the Merchant Boarding form is to provide information about the merchant’s business owners.

A primary owner is typically someone who has at least 50.01% ownership (this can vary with corporations and non-profit organizations).

For questions regarding the correct owner, we recommend reaching out to our Underwriting and Boarding Team.

Note that with respect to the new requirement to obtain beneficial ownership information, financial institutions will have to identify and verify the identity of any individual who owns 25 percent or more of a legal entity, and an individual who controls the legal entity. In this instance, a secondary owner will be required.

For government agencies, non-profit companies, and public companies where there is no owner, supply the information of an executive officer.

*By clicking COPY FROM BUSINESS, these fields will populate the information entered for the business on Step 1.

Field | Required | Description |

|---|---|---|

First Name | Required | The first name of the primary owner for the business. |

Last Name | Required | The last name of the primary owner for the business |

DOB (mm-dd-yyyy) | Required | The date of birth for the business primary owner. |

SSN | Required | The Social Security number for the business primary owner. |

Business Title | Required | The title the merchant holds in relation to associated business, such as Owner, CEO, Comptroller, or Executive Officer |

Ownership % | Required | The percent of ownership the primary owner has for the business. |

Drivers License | Optional | The driver’s license of the primary owner. |

DL State | Optional | The driver’s license state of the primary owner |

Significant Responsibility | Required | Is the primary owner a “Control Prong” of this business? In other words, is the primary owner a controlling authority of the business, including (but not limited to) these roles: Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Managing Member, General Partner, President, Vice Presidents, or an individual with significant legal authority to enter the Legal Entity into a commercial relationship. |

Politically Exposed Person | Required | Is the primary owner a politically exposed person? Politically exposed is defined as any person who, through their prominent position or influence, is more susceptible to being involved in bribery or corruption. |

Address, Address 2, City, State, Zip | Required | The merchant's street address that is used on their tax form. PO Boxes are not allowed. *The merchant time zone is automatically set based on the location of the business’s address. |

Required* | The merchant’s email address used for electronic communication. | |

Owner Phone | Required* | The primary owner's phone number. |

Step 3: Account Setup

The third step of the Merchant Boarding form is to obtain the platform account information for the merchant.

Field | Required | Description |

|---|---|---|

Boarding Status | Required | Indicates whether the merchant is ready to be sent to processor or is saved.

|

Add MCC | Required | Merchant Category Code (MCC) for merchant. MCCs must be preapproved by the Payrix Risk/Underwriting team. |

Merchant Type* | Optional | Indicates the business category most relevant to the market vertical for the merchant. *Select the one most relevant to your company:

|

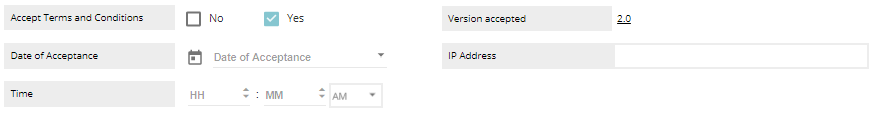

Accept Terms and Conditions | Optional* Default is No | *Note this field is required for boarding but not for saving the merchant (in other words, Not Ready boarding status) |

Date of Acceptance* | Optional *Displays when Accept Terms and Conditions is set to Yes | Date that the merchant accepted the T&C. |

Time* | Time that the merchant accepted the T&C. | |

Version Accepted* | The T&C version is automatically set by Payrix based on the version available in the Portal. | |

IP Address* | Supply an IP Address of the merchant accepting the T&C for verification purposes. | |

| ||

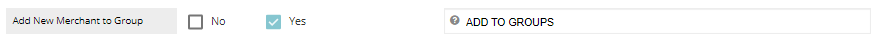

Add New Merchant to Group | Optional Default is No | Add merchant to a existing group, which is used to pre-define the merchant fees, costs, reserves, withdrawal flows, and profit shares for every merchant within the group. |

ADD TO GROUPS* | Optional *Displays when Add New Merchant to Group is set to Yes | Can add merchants to an existing group. A dropdown menu with options will display when the box is selected. |

| ||

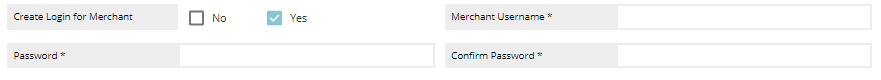

Create Login for Merchant | Optional Default is No | This creates a new user in Payrix that will only have access to this merchant. An email will be sent to the user after the merchant account is created. |

Password* | Required *Displays when Create Login for Merchant is set to Yes | Define merchant password. |

Merchant Username* | Define merchant username for their login. | |

Confirm Password* | Confirm merchant password for their login. | |

| ||

Step 4: Add Bank Account

The fourth step of the Merchant Boarding form is to obtain the Merchant’s bank account information.

Field | Required | Description |

|---|---|---|

Bank Account Type | Required | The type of bank account for the merchant such as Checking, Savings, Corporate Checking, or Corporate Savings. Indicating whether the Merchant’s bank account is a personal or corporate account is important. |

Bank Routing Number | Required | The bank account number for the merchant. |

Bank Account Number | Required | The bank account routing number for the merchant. |

.png)