eCheck & EFT payments - Canada

Accept eCheck and EFT payments on the Portal, PayFields page, or using the Payrix API.

Payrix provides tools that make it easy for merchants to accept eCheck and EFT payments. Payrix’s solution is easy to implement and reduces associated risks. This page provides details about the eCheck/EFT options provided by Payrix. The following resource provides details for merchants using Payrix’s eCheck feature:

The Payrix platform’s standard processing time is 5 business days, which ensures the payment is fully funded before disbursing the funds to your client. To improve merchant cashflow, Payrix’s eCheck/EFT solution supports pre-funding merchants for eCheck payments that are still processing. Pre-funding options are available based on a business case and risk approval basis.

Currently, our customers can process eCheck transactions in the Portal & via Quick Charge - Easily toggle between accepting card and EFT transactions directly within the Portal. To complete this process, locate Quick Charge or the expanded payment fields in the Portal, and select eCheck Sale from the Transaction Type dropdown menu (by default, this field is set to Sale).

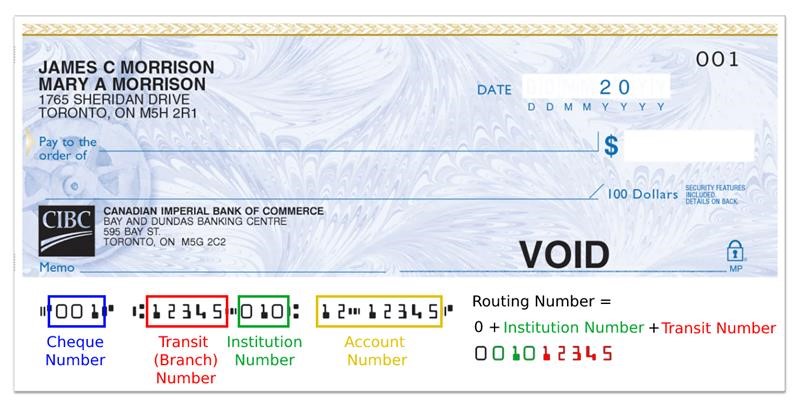

Canada EFT Routing Number Formatting

When accepting Canadian EFT payments, the entered routing number is different from US ACH number formatting.

The routing number in Canada must appear as a 9-digit number in ACH Universal. If the Institution is only a 3-digit number, you'll add a leading zero.

Example:

If the account number listed is 01144 039

01144 being the branch number (5 digits)

039 being the institution number (3 digits)

The number MUST be entered in the following combination:

0 + (Institution number) + (Branch Number) = Payments EFT routing number entry format. See the example below.

Direct API - Submit eCheck transactions directly via our API using the account/routing information and first name of the bank account holder to the /txns endpoint.

.png)