A negative disbursement refers to funds that are debited from a Merchant’s Account Balance, in contrast to a positive disbursement, where funds are credited to the Merchants Account Balance. The Account Balance, also called available balance, is the sum of all the entries on a Merchant’s account.

Learn more about a Merchant’s Account Balance using the Merchant Balance Details page.

Negative disbursements, also called debits, can be triggered for a number of reasons:

Profit shares and fees

Refund processing

Incoming chargebacks

Reserve balances

Unique risk setups

A debit is triggered based on the Merchant’s Account Balance. This process is designed to process a disbursement from the Merchant’s listed bank account to bring their Account Balance from a negative amount back to $0.00.

If any pending entries are active when a debit is triggered, the amount debited will be reduced by an equal amount.

Details can be found regarding each negative disbursement inside the Balance Details Report.

Negative Disbursement Parameters

The Payrix Pro Risk team can define specific parameters that dictate the amount an account can be negative, and when a debit will be triggered to cover the balance. The following sections describe each parameter.

Debit Grace Period

The Debit Grace Period parameter determines the number of days before a Merchant will be debited to cover their negative balance. This allows a Merchant to process more transactions or resolve other outstanding balances to become positive.

The Payrix Pro Risk team sets an appropriate grace period based on the Merchant’s unique business model.

Negative Balance Limit

The Negative Balance Limit parameter determines the maximum amount by which a Merchant’s Account Balance can be negative before a debit is automatically triggered.

Similar to the Debit Grace Period parameter, the Payrix Pro Risk team sets a reasonable amount for the Negative Balance Limit parameter based on the Merchant’s risk profile.

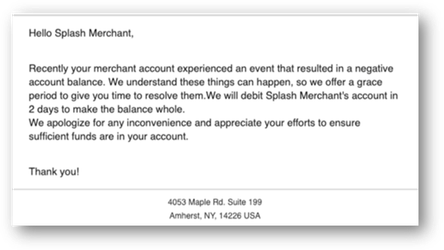

Negative Balance Email

The Negative Balance Email parameter determines whether an email will be sent to the Merchant notifying them of their negative balance and the grace period they have before they are debited to make their balance positive again.

This parameter can also be modified in the Email Alerts page.

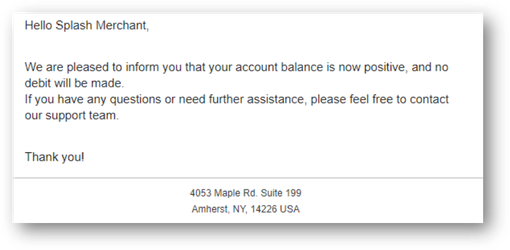

Positive Balance Email

The Positive Balance Email parameter determines whether an email will be sent to the Merchant notifying them that their balance is no longer negative and that the previously scheduled grace period expiration debit has been canceled.

This parameter can also be modified in the Email Alerts page.