GIACT's gVERIFY is a real-time account verification service that confirms bank account legitimacy for eCheck transactions. It verifies that the account is open, active, and in good standing before processing payments to reduce fraud risk, administrative returns, and chargebacks. This service is useful for partners looking to improve transaction success rates and optimize risk management.

Each verification attempt incurs a fee, regardless of the verification result. After first-time verification, future transactions from the same account won't incur additional charges. If a transaction is blocked, an Adverse Action Notice must be given to the consumer as required by the Fair Credit Reporting Act (FCRA).

This guide covers how to configure GIACT eCheck Verification Fees and review GIACT Inquiry Alerts within the platform. These steps are prerequisites for enabling fee collection and visibility into verification activity.

For complete integration with the GIACT gVERIFY service, you must:

Submit an Implementation Services ticket for API Support and work with the Implementation Team to enable GIACT for your account and help you set up Risk Microservice API credentials.

Use the Perform a GIACT eCheck Verification developer integration guide on the Worldpay Developer Hub for library configuration scripts and necessary API calls to initiate GIACT verifications.

Apply a GIACT eCheck Verification Fee

After GIACT eCheck Verification Fees are configured like any other fee on the Payrix Pro platform, from the Group Profile page or Merchant Profile page. The following steps can be used on the Group Profile page for Group configurations, or from the Merchant Profile page, for individual merchant assignment in the Portal:

Select Groups from from the left navigation panel.

Select your desired Group from the list to open the Group Profile page.

Click the Fees tab on the Group Profile page to open the Fees menu.

Click ADD FEES in the Fees menu to open the Add Fees dialog.

For When to trigger a fee? select GIACT Echeck Verification.

Set How much is the fee?, Fee start date, Fee name, and Currency as needed.

Click Add to complete setting up the fee.

Result: The GIACT eCheck Verification Fee now applies to all merchants in the Group. When a GIACT Verification fee is assessed to your account, it will automatically assess a fee to the merchant that triggered the verification to cover the verification service costs. With the GIACT eCheck Verification Fee set up, you can now run policy checks on transactions, allowing automated risk decisions based on eCheck verification responses.

Notes

For guidance on setting up Groups and adding merchants, see Set Up a Group.

For details on setting up Fees, see Fee Type Configuration Parameters.

Review GIACT Inquiry Alerts for Merchants

As a Payrix Pro partner, you can use the following endpoint to run a GIACT policy check on a specific transaction or a set of transactions. When an eCheck transaction fails (status = 2), you need to verify if the transaction was blocked by the GIACT rule. If it was, you should display the Adverse Action Notice (AAN). See the Policy Run Summary Sandbox Testing section for more information.

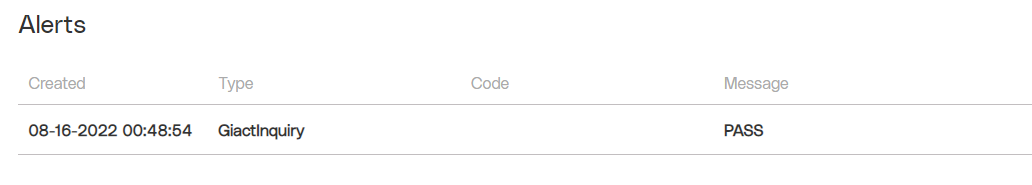

GIACT Inquiry alerts are shown in the Alerts menu of the Merchant Profile page of the merchant performing the transaction.

Note

Partners and merchants cannot see the GIACT Inquiry Check Code value. Additionally, Worldpay for Platforms is not permitted to disclose the nature or reason for a GIACT response to merchants or partners. All GIACT Inquiry Check codes are sent directly from the bank issuers. Account holders must contact their bank for more information on any hold or decline responses sent to the Payrix Pro platform.

The following table lists the possible GIACT Inquiry Check response messages and the descriptions:

Message | Description |

|---|---|

SKIP | The data submitted did not meet the initial requirements to begin a GIACT review. |

BLOCK | The transaction data was reviewed with GIACT and has been declined with an assessed fee. Note: If a BLOCK is issued from a GIACT Inquiry Check, the Adverse Action Notice must be displayed. |

PASS | The transaction data was reviewed with GIACT and approved with an assessed fee. |

Adverse Action Notice Message

For GIACT Inquiry Check BLOCK responses, the following Adverse Action Notice must be displayed to the customer:

Adverse Action Notice

Learn more about this declined transaction-

Check if you have entered the correct bank account and routing details.

Check if your bank account is in good standing.

If the details are correct and are in good standing, This notice is intended to comply with the requirements of the federal Fair Credit Reporting (FCRA). We are unable to process your request because we were unable to verify or authenticate your account information. Our decision was based in whole, or in part, on information obtained from a consumer reporting agency, LSEG Risk intelligence (Giact). However, LSEG Risk intelligence played no part in the decision process and is unable to supply specific reasons for the denial of services. Under the FCRA, you have a right to know the information contained within your report. You also have a right to make a written request, no later than 60 days after you receive this notice, for disclosure of this information. You may request a free consumer report from LSEG Risk intelligence no later than 60 days following the receipt of this notice. You may also dispute information contained in the report if you believe that it is inaccurate or incomplete. LSEG Risk intelligence’s contact information is provided below: LSEG Risk intelligence (Giact) 700 Central Expy S. Suite 300 Allen, TX 75013 1 (833) 802-8092.

Test Responses with GIACT Simulators

You can simulate specific GIACT responses to eCheck verifications by using the following values when adding a new eCheck account:

Simulator Response Message | Description | Type | Routing Number | Account Number |

|---|---|---|---|---|

BLOCK | The transaction is not processed. | Personal Checking | 122105278 | 0000000004 |