Sandbox Testing Triggers

Payrix Pro Sandbox environment simulation parameters to trigger specific scenarios.

Using the Sandbox version of the Portal allows you to test scenarios normally impossible in testing. We’ve created a set of specific amounts that trigger an automatic decline, error, or other message that would normally only occur from an actual customer transaction.

See the instructions below for a quick start to testing additional sandbox triggers.

Note: Any amount entered outside of the trigger amounts specified below will result in a standard successful response expected from the server for normal testing purposes.

Sandbox Testing Triggers

To test additional transaction events using this trigger system, follow the steps above but replace the transaction amount from the example ($500.01) with one of the transaction amounts from the Testing Triggers expandable table below.

Category | Transaction Amount | Message | Note |

|---|---|---|---|

Card Transaction | $95.87 | Declined | |

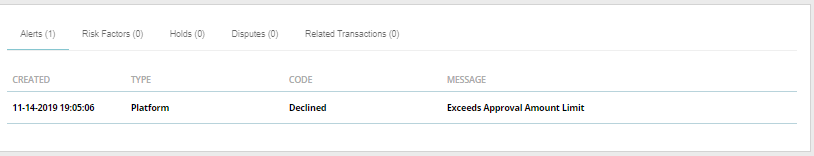

$500.01 | Exceeds Approval Amount Limit | ||

$500.04 | Insufficient Funds | ||

$500.13 | Corporate Customer Advises Not Authorized (for eCheck transactions) | ||

$848.00 | Processing Network Unavailable | ||

$848.01 | Issuer Unavailable | ||

$848.02 | Re-submit Transaction | ||

$848.03 | Call Issuer | ||

$848.04 | Merchant not certified/enabled for IIAS | ||

$848.05 | Issuer Generated Error | ||

$848.06 | Restricted Card | ||

$848.07 | Card Not Active | ||

$848.08 | Illegal Transaction | ||

$848.09 | Duplicate Transaction | ||

$848.10 | System Error | ||

$848.11 | System Error (cannot process) | ||

$848.12 | Lost/Stolen Card | ||

$848.13 | Expired Card | ||

$848.14 | Restricted Card | ||

$848.15 | No such issuer | ||

$848.16 | Transaction not allowed at terminal | ||

$848.17 | Cardholder transaction not permitted | ||

$848.18 | Cardholder requested that recurring or instalment payment be stopped | ||

$848.19 | Do Not Honor | ||

$848.20 | Decline - Request Positive ID | ||

$848.21 | Processing Network Error | ||

$848.22 | Soft Decline - Primary Funding Source Failed | ||

$848.23 | Soft Decline - Auto Recycling In Progress | ||

$848.24 | Internal System Error - Call Vantiv | ||

$848.25 | Generic Decline | ||

Batch Echo | $10.10 | Partially Approved | |

$10.11 | Offline Approval | ||

$11.08 | Try again later | ||

$11.11 | The total amount of the original Authorization has been used. | ||

$22.07 | Pickup card - Other than Lost/Stolen | ||

$22.09 | Invalid Amount | ||

$22.11 | Reversal Unsuccessful | ||

$22.12 | Missing Data | ||

$33.01 | Invalid Account Number | ||

$33.03 | Pick Up Card | ||

$33.08 | Restricted Card - Chargeback | ||

$33.23 | No such issuer | ||

$33.48 | Invalid Report Group | ||

$33.60 | There were no transactions found with the specified Transaction Id. | ||

$33.61 | The authorization for this transaction is no longer available. Either the authorization has already been consumed by another capture, the authorization has expired, or the cardholder revoked the authorization. | ||

$33.62 | This transaction cannot be voided; it has already been delivered. | ||

$33.63 | This transaction (both capture and refund) has been voided. | ||

$33.69 | The redeposit attempted against an invalid transaction type. | ||

$33.70 | Internal System Error - Call Vantiv | ||

$33.71 | Do not send additional redeposit transactions, since the original transaction was processed. | ||

$55.01 | The account was closed | ||

Disbursements | Disbursement Amount | Message | |

$101.25 | Insufficient funds in account | ||

$201.26 | Account is closed | ||

$301.27 | No account on file | ||

$401.28 | Invalid account number | ||

$501.29 | Unauthorized debit to consumer account | ||

$601.31 | Returned at request of ODFI | ||

$100,000.00+ | Exceeds Approved Disbursement Amount Limit |

Using Sandbox Testing Triggers

Use the steps below to set up a transaction with the desired trigger amount.

For Card Transaction Triggers

Step 1: Go to the Create Payment page.

Step 2: Create a charge for a specific trigger amount. (See the table above).

Step 3: Run the transaction with a test card number 4242 4242 4242 4242 (with any combination of “CVV” and future “Expiration” values).

Step 4: Locate the transaction in the Payments History page list. Then click on the transaction to be taken to Transaction Details.

Step 5: Click the Alerts tab from the Transaction Details menu in the lower half of the page. See the result below.

For Disbursement Triggers

Step 1: Go to the Payouts page

Step 2: Click the View Schedules button to access the Payout Schedules page.

Step 3: Click the Schedule Payout button in the upper right corner.

Step 4: Set the following parameters and click the Schedule Payout button in the modal:

How often would you like to withdraw: One-Time

Amount: A specific Disbursement trigger amount (see the table above).

Amount Type: Actual

Step 5: Allow the Payout to process in real-time (each day at 6:30 PM EST).

Step 6: Return to the Payout page, and click the Payout Details button next to the payout you attempted under the Payout History section.

Step 7: The Alerts section will display the message for your specified trigger, and display the amount under the Not Paid Out table. See the results below.

Sandbox Testing Trigger API Response Structure

Whether sending these testing trigger transactions using our Portal or API, you’ll receive a response returned from our servers that looks like the JSON file below. This is simply the API version of the messages you’ll see in the Alerts tab of the Portal as mentioned above.

More Information

You can read more about different API-based testing triggers by visiting our API Reference documentation.