A Dispute refers to an available action a cardholder can take to argue against fraudulent charges, billing errors, or issues with the product or service provided not meeting expectations, for example.

Typically, the preliminary stage to a formal Dispute is a cardholder complaint to the merchant. The merchant should first engage directly with the cardholder where possible to understand their concerns, address potential issues, and work with the customer to resolve any outstanding issues amicably.

Tip

Open communication between merchants and customers is one of the best ways to avoid a formal Dispute and chargeback.

A Dispute is first initiated by the cardholder (customer of the product or service provided) through their Issuer (the card brand, such as Visa or Mastercard), and goes through a series of reviews, actions, and decisions to eventually rule in favor of the merchant or cardholder respectively.

You can find and review all disputes in your portfolio by visiting the Disputes page in the Portal. To view individual dispute details, including a dispute status tracker, visit the Dispute Details page in the Portal.

Dispute Stages

Dispute Stages are the primary milestones that a merchant can expect to see when handling Disputes. These six stages

Retrieval: The Issuer is looking for more information about the transaction.

First Chargeback: The cardholder is disputing the transaction payment.

Representment: Both the merchant and cardholder submit their first round of supporting evidence.

Pre-Arbitration: The cardholder lost the first Dispute and both parties will submit more evidence.

Arbitration: The cardholder lost the second Dispute and both parties will arbitrate further with the card brand.

Reversal: The Issuer has acknowledged that the transaction is valid and will return funds to the merchant.

Important!

Please note that the platform does not offer steps to handle Disputes in the Arbitration stage and must be discussed directly with the Issuer’s Card Brand, such as Visa or MasterCard.

Dispute Statuses

To get started, you’ll want to get familiar with the 4 available Dispute Statuses you’ll frequently encounter:

Needs Response: The Issuer is awaiting the merchant’s evidence, or to Accept Liability, for the Dispute.

In Review: The Issuer is in the process of reviewing submitted evidence to reach a decision.

Won: The Issuer has decided in favor of the merchant.

Lost: The Issuer has decided in favor of the cardholder.

See a table of all Dispute Stage and Status combinations and actions below:

Stage | Status | More Information |

|---|---|---|

Retrieval | Needs Response | The Issuer is requesting supporting documentation for the transaction in question, such as terms and services or proof of purchase. This is a precursor to an actual chargeback. The chargeback cycle of Retrieval will not change and there is no financial impact on the merchant.

|

First Chargeback | Needs Response | A first Dispute payment chargeback has been opened and has not yet been responded to by the merchant. The merchant has two available options:

|

Won | After all evidence and arbitration have been completed by the Issuer, the chargeback has reached a final decision of “Won” in the merchant’s favor.

| |

Lost | After all evidence and arbitration have been completed by the Issuer, the chargeback has reached a final decision of “Lost”, or against the merchant.

| |

Reversal | Won | This decision is final. |

See a matrix of the financial impact of each Dispute Stage and Status to the merchant below:

Stage | Status | Financial Impact |

|---|---|---|

Retrieval | Needs Response | No Impact. |

First Chargeback | Needs Response | No Impact. |

Won | The merchant receives a credit. (+) | |

Lost | The merchant is charged a debit. (-) | |

Representment | Needs Response | No Impact. |

In Review | No Impact. | |

Won | The merchant receives a credit. (+) | |

Lost | The merchant is charged a debit. (-) | |

Pre-Arbitration (Second Chargeback) | Needs Response | No Impact. |

In Review | No Impact. | |

Won | The merchant receives a credit. (+) | |

Lost | The merchant is charged a debit. (-) | |

Arbitration | In Review | The Merchant is assigned arbitration fees by a card brand. |

Won | The merchant receives a credit. (+) | |

Lost | The merchant is charged a debit. (-) | |

Reversal | Won | The merchant receives a credit. (+) |

When you’re ready to respond to a Chargeback Cycle and/or Dispute Stage, visit Dispute Response Options.

Supporting Documentation / Evidence

When a Dispute is initiated, the Issuer may request a detailed explanation of the problem from the cardholder to determine whether a cause for a legitimate Dispute exists.

Reasons for Disputes—those reasons that may be of assistance in an investigation include the following:

The merchant failed to get authorization

The merchant failed to obtain a card imprint (electronic or manual)

The merchant accepted an expired card

Supporting documentation or evidence is the primary way for an Issuer to see the validity of the transaction during review and reach a decision. It is critical for merchants to submit this to have the best chance to win a Dispute.

Below are the different types of evidence a merchant can provide to help support their claims:

Formal Evidence

This includes official documentation directly related to the transaction.

Formal evidence includes, but is not limited to:

Signed credit card receipt

Completed credit card authorization form

Corresponding Invoice with cardholder contact information

Signed proof of delivery or Satisfactory Services

Informal Evidence

Informal evidence is relevant documentation that is not directly related to the transaction.

Informal evidence includes, but is not limited to:

Logs of correspondence between the merchant and cardholder

Screenshots of the merchant’s website and/or published Terms of Service

Pictures of the merchandise

A summary of the incident written by the merchant

Note

View the current limitations for response file uploads:

Maximum of 8 documents total

A single document can’t exceed 1 MB

The total of all files cannot exceed 8MB

File Format – Must be either TIFF/TIF or PDF

Must be submitted within the Payrix Pro portal or API 5 business days before the due date.

Important!

Any Supporting Documents submitted as evidence must include the Chargeback ID and/or Issuer Dispute Case Number for review. The Chargeback ID can be found on the Dispute Details page or can be found by making a GET request to the /chargebacks endpoint to locate it.

If the merchant doesn't submit a response, the chargeback is automatically ruled in the cardholder's favor.

Card brand Suggested Receipt and/or Invoice Requirements

See the information below for suggestions regarding supporting documentation or evidence submissions for Disputes. Refer to the recommendations for Dispute Supporting Documentation listed below:

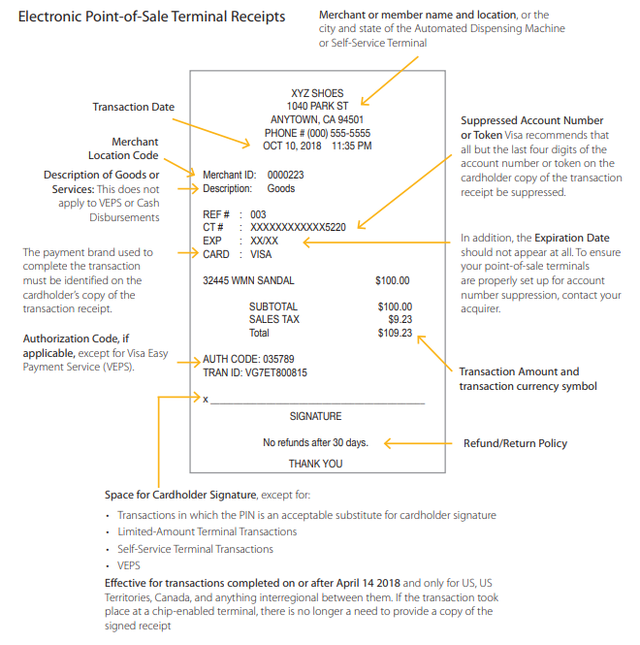

Card Present Transaction Receipt Requirements

The following are the Visa requirements for all transaction receipts generated from electronic point-of-sale terminals (including cardholder-activated terminals). It is recommended that merchants provide itemized receipts when possible.

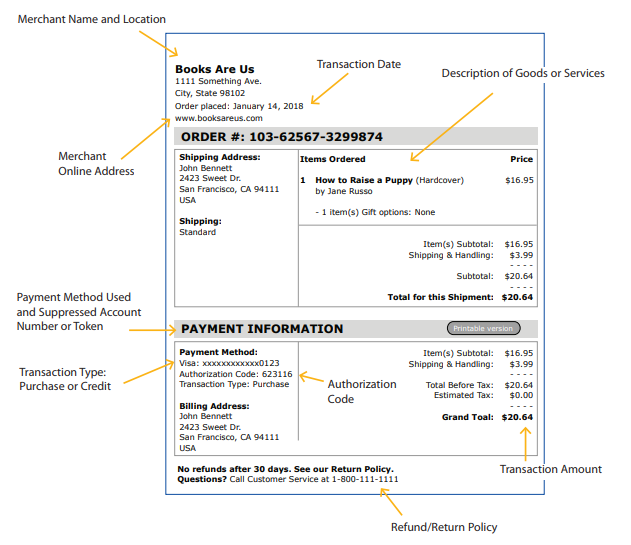

Card-not-Present Transaction Receipt Requirements

The following are the Visa requirements for all manually printed transaction receipts in the card-absent environment:

Types of Evidence

Credit Card Authorization Documentation

Card brands also consider the following acceptable ways of documenting a cardholder's approval for a transaction:

For a Mail/Phone Order Transaction a signed order/authorization form.

Details and a copy of the ID presented by the cardholder

Evidence of Transaction completion by a member of the cardholder's household or family (if not by the cardholder).

Proof of Delivery or Satisfactory Services

Cardholder goods receipt or satisfactory service rendering confirmation is one of the best protections a merchant can have. Some of the best details are indicated below:

Photos, Screenshots, Emails, or Recorded Phone Calls proving that the cardholder disputing the Transaction has, or is currently using the products or services.

Product or service pick-up form with the cardholder’s signature.

Evidence of product delivery date and time with the same physical address that returned an AVS match of Y or M. (Signature not required.)

A neutral third-party opinion to help corroborate your claim against the cardholder.

Dispute Stage Processing Flows

See the diagrams available below for a visual representation of each Dispute Stage flow:

Retrieval

The following diagram demonstrates the Retrieval stage process:

First Chargeback

The following diagram demonstrates the First Chargeback stage process:

Pre-Arbitration

The following diagram demonstrates the Pre-Arbitration stage process:

Note

Arbitration is not included here as it does not take place on this platform.

Dispute vs Chargeback

A Dispute and a Chargeback are two distinct processes related to payment Disputes.

A Dispute occurs when a customer is questioning a transaction with their issuing bank or credit card company, typically due to concerns raised around unauthorized charges, billing errors, or overall dissatisfaction with a product or service. This can be a formal process initiated through their Issuer or credit card company during the preliminary Chargeback proceeding or an informal process where concerns are raised by the cardholder directly and discussed with the merchant to seek a resolution.

A Chargeback occurs when a cardholder bypasses the merchant entirely to Dispute the transaction with their Issuer or credit card company to reverse a transaction. Chargebacks are typically more formal and can also incur additional fees from a merchant perspective. Chargebacks are typically initiated due to claims of fraud, or failure to receive goods or services.

Both listed processes above require prompt response from the merchant with compelling evidence provided to support their transaction’s validity.