Setup GIACT eCheck Verification

GIACT’s gVERIFY® provides real-time status updates for business or customer accounts, ensuring they are validated before approving a deposit or accepting payment.

Getting Started

Before running eCheck Verifications for Merchant transactions, you need to set up a GIACT eCheck Verification Fee and then apply it to the Merchant or add the Merchant to an existing Group with the fee set up.

Now that you’ve set up the GIACT eCheck Verification Fee, you can begin running policy checks on transactions. This will allow you to apply automated risk decisions based on eCheck verification responses.

Reviewing GIACT Check Alerts for Merchants

API Request - Policy Run Summary

As a Payrix Pro partner, you can use the following endpoint to run a GIACT policy check on a specific transaction or a set of transactions. When an eCheck transaction fails (status = 2), you need to verify if the transaction was blocked by the GIACT rule. If it was, you should display the Adverse Action Notice (AAN).

API Details

Base URL |

See the Policy Run Summary Sandbox Testing section for more information. |

Endpoint |

|

HTTP Method |

|

Full HTTP Request |

|

Required Headers

Header | Valid Values | Notes |

|---|---|---|

|

| This needs to be a JSON content type. |

|

| This can be found on the Portal Settings page in Sandbox or Production. |

|

| Deprecated field, but still required to be sent in the headers. |

Query Parameter

Parameter | Type | Required | Notes |

|---|---|---|---|

| string | Yes |

The transaction ID entered here will also appear in the |

Policy Run Summary Response Parameters

The expandable content below gives more in-depth information about the specific parameters available and required in the response body:

Policy Run Summary Response Body Example

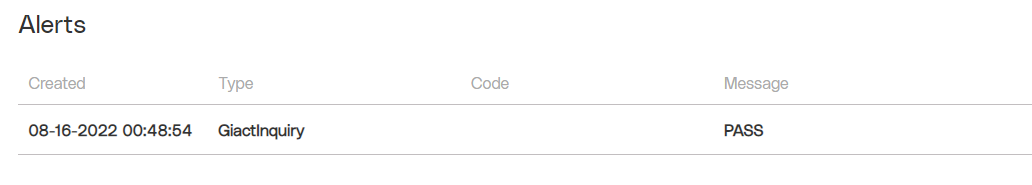

GIACT Alerts in the Portal

The GIACT Check alerts will be shown in the Alerts section of the Merchant Profile page of the Merchant performing the transaction.

Note

Only Facilitators can view the GIACT Code field on this page. Referrers and Merchants are unable to view the specific GIACT Check block code. Additionally, Worldpay for Platforms is not permitted to disclose the nature or reason for a GIACT response to Merchants or Referrers.

The following table lists the possible GIACT Inquiry Check response messages and the descriptions.

Message | Description |

|---|---|

SKIP | The data submitted did not meet the initial requirements to begin a GIACT review. |

BLOCK | The transaction data was reviewed with GIACT and has been declined with an assessed fee. If a BLOCK is issued from a GIACT Inquiry Check, the Adverse Action Notice Requirement Message (shown below) should be displayed. |

PASS | The transaction data was reviewed with GIACT and approved with an assessed fee. |

Learn more about this declined transaction-

Check if you have entered the correct bank account and routing details.

Check if your bank account is in good standing.

If the details are correct and are in good standing, This notice is intended to comply with the requirements of the federal Fair Credit Reporting (FCRA). We are unable to process your request because we were unable to verify or authenticate your account information. Our decision was based in whole, or in part, on information obtained from a consumer reporting agency, GIACT Systems, LLC. However, GIACT Systems, LLC played no part in the decision process and is unable to supply specific reasons for the denial of services. Under the FCRA, you have a right to know the information contained within your report. You also have a right to make a written request, no later than 60 days after you receive this notice, for disclosure of this information. You may request a free consumer report from GIACT Systems, LLC no later than 60 days following the receipt of this notice. You may also dispute information contained in the report if you believe that it is inaccurate or incomplete. GIACT Systems, LLC’s contact information is provided below: GIACT Systems, LLC 700 Central Expy S. Suite 300 Allen, TX 75013 1 (833) 802-8092”

GIACT Microservice Implementation Example

This example illustrates a front-end service operating on localhost:3000, paired with a back-end service on localhost:5000. Together, they exemplify the microservice architecture essential for securely handling any HTTP calls that involve sensitive keys. This configuration is specifically designed to safeguard private API keys needed for these requests, thereby reducing the risk of exposure.

Front-End Service

When using PayFields, you have access to the callbacks mentioned in the following table. In the case of a response within the PayFields.onFailure callback, you must determine whether it constitutes a GIACT error.

Available PayFields Callbacks

Action | Description |

|---|---|

| Runs when the API responds with a successful transaction or token |

| Runs when invalid or incomplete cardholder or payment data is entered |

| Runs when API Key, Transaction Session Key, or Merchant ID fails validation before creating the API call or when the API responds with a failed transaction or token |

| Runs when the API responds |

| Runs when |

| Runs when |

GIACT Function

In this example, the GIACT function requires a transaction ID as a parameter and initiates a GET request to the back-end server http://localhost:5000/giact-data/{txnId}, which is wrapped in a returned promise. This allows waiting for a response from the back-end server before proceeding to display the appropriate error message.

function GIACT(txnId) {

return new Promise((resolve, reject) => {

try {

fetch(`http://localhost:5000/giact-data/${txnId}`)

.then((response) => response.json())

.then((data) => {

resolve(data.action);

});

} catch (error) {

console.log("Failed to call GIACT verification service");

reject(error);

}

});

}

onFailure Callback

Within the definition of the PayFields.onFailure callback, you can call the function above if PayFields.config.txnType = “ecsale” to initiate an additional required GET request that the back-end service executes.

window.PayFields.onFailure = (response) => {

let transactionId = response.data[0]

? response.data[0].id

: console.log("no transaction Id found");

if(window.PayFields.config.txnType = "ecsale") {

GIACT(transactionId).then((res) =>

res == "BLOCK"

? alert(

"**ADVERSE ACTION NOTICE** \n\n 1) Check if you have entered correct bank account and routing details.\n\n 2) Check if your bank account is in good standing. \n\n 3) If the details are correct and is in good standing, This notice is intended to comply with the requirements of the federal Fair Credit Reporting (FCRA). We are unable to process your request because we were unable to verify or authenticate your account information. Our decision was based in whole, or in part, on information obtained from a consumer reporting agency, Giact Systems, LLC. However, Giact Systems, LLC played no part in the decision process and is unable to supply specific reasons for the denial of services. Under the FCRA, you have a right to know the information contained within your report. You also have a right to make a written request, no later than 60-days after you receive this notice, for disclosure of this information. You may request a free consumer report from Giact Systems, LLC no later than 60-days following the receipt of this notice. You may also dispute information contained in the report if you believe that it is inaccurate or incomplete. Giact Systems, LLC’s contact information is provided below: GIACT Systems, LLC 700 Central Expy S. Suite 300 Allen, TX 75013 1 (833) 802-8092."

)

: alert("giact error response")

);

}

//Non GIACT error

console.log(response);

};In the response received from calling the GIACT function (example below), you can determine the cause of the failure. If the response from the call is BLOCK, at that point you need to display an Adverse Action Notice to the user.

*The GIACT function returns only the action attribute off of the example response.

GIACT Response Status

Message | Description |

|---|---|

SKIP | The data submitted did not meet the initial requirements to begin a GIACT review. |

BLOCK | The transaction data was reviewed with GIACT and has been declined with an assessed fee. If a BLOCK is issued from a GIACT Inquiry Check, the Adverse Action Notice Requirement Message (shown below) will be displayed. |

PASS | The transaction data was reviewed with GIACT and approved with an assessed fee. |

Back-End Service

To make a request to the GIACT endpoint, a private API key is required. Therefore, to ensure the API key’s security, the GIACT HTTP call is stored in a separate back-end service, preventing the key from being exposed in public client-side network request.

The below example of a server-side request takes a transaction ID as a request parameter to use for the GIACT call. This ID is passed through req.params, which is captured in a variable called txnId. In the front-end service, this ID is passed within the GIACT function. This transaction ID is required to call the GIACT endpoint.

The second portion of this example is the sensitive part. On line 10, we make a request to the GIACT endpoint, which requires the following:

GIACT Endpoint Requirements

Required Header | Valid Values | Notes |

|---|---|---|

|

| None |

|

| This can be found on the Portal Settings page. |

|

| Deprecated field; |

We then return the entire response in a new variable named result_data, as illustrated in the example GIACT response above. This approach effectively separates the GIACT call from any metadata associated with the network request, allowing us to send only the response JSON payload back to the front-end service.

app.get('/giact-data/:txnId', async (req, res) => {

let txnId = req.params.txnId

let result_data

let sandbox_base_url = "https://apiv2.stage.payrix.com/risk/v2"

let production_base_url = "https://apiv2.payrix.com/risk/v2"

console.log(txnId);

let giact_url = `${sandbox_base_url}/decision/policy-run-summary?stage=auth&transactionId=${txnId}`

await fetch(giact_url, {

headers: {

"Content-Type": "application/json",

"Authorization": config.private_api_key,

"legacy-auth-header-name": "APIKEY"

}

})

.then(res => res.json())

.then(data => {

result_data = data

})

.catch(err => console.log(err))

console.log(result_data);

res.json(result_data)

})Full Example (How to run locally)

This example serves to illustrate a proper method for making an HTTP call while ensuring that the private API key remains secure and undisclosed.

Front End

Requirements

- Public API key

- Merchant ID

Open the project in VS Code and do the following:

Find a file named config.json in /src to insert the requirements.

Within a terminal, change the directory to giact_example/front-end.

Run

npm install.Run

npm startto serve the react app on port 3000.

Back End

Requirements

- Private API key

Open the project in VS Code and do the following:

Find a file named config.json to insert the requirements.

Within a terminal, change the directory to giact_example/giact-service.

Run

npm install.Run

npm startto run the express server on port 5000.

Policy Run Summary Sandbox Testing

Creating a test transaction to execute a Policy Run Summary is done in two parts:

Create a new transaction using testing trigger payment method values.

Process a POST request using the /txns endpoint, with the following values in the payment object within:

Use the returned

idresponse value to execute the Policy Run Summary.

Result: You successfully created a test GIACT action response to either block, hold, or reserve funds for a transaction, as well as allowing the transaction to process as normal, being marked for further review at a later time.

Example Response:

{

"uuid": "XXX7c-038a-4881-af7d-7c029e022bbd",

"policyUuid": "XXX90c-6b40-40fe-90e7-406da5d70852",

"subject": "t1_txn_12a3bc4de56f789012gh3ij",

"action": "BLOCK",

"results": [

{

"decisionType": "GiactTxnInquiry",

"result": "BLOCK"

}

]

}