Parameters (Referrer Profile)(F)

The Parameters page is a streamlined configuration page that allows users to quickly enable and set exact values for processes like Merchant Boarding, Transaction Processing, Withdrawals, and other additional process options.

Parameters can be assigned to Divisions, Groups, or individual Referrers and Merchants.

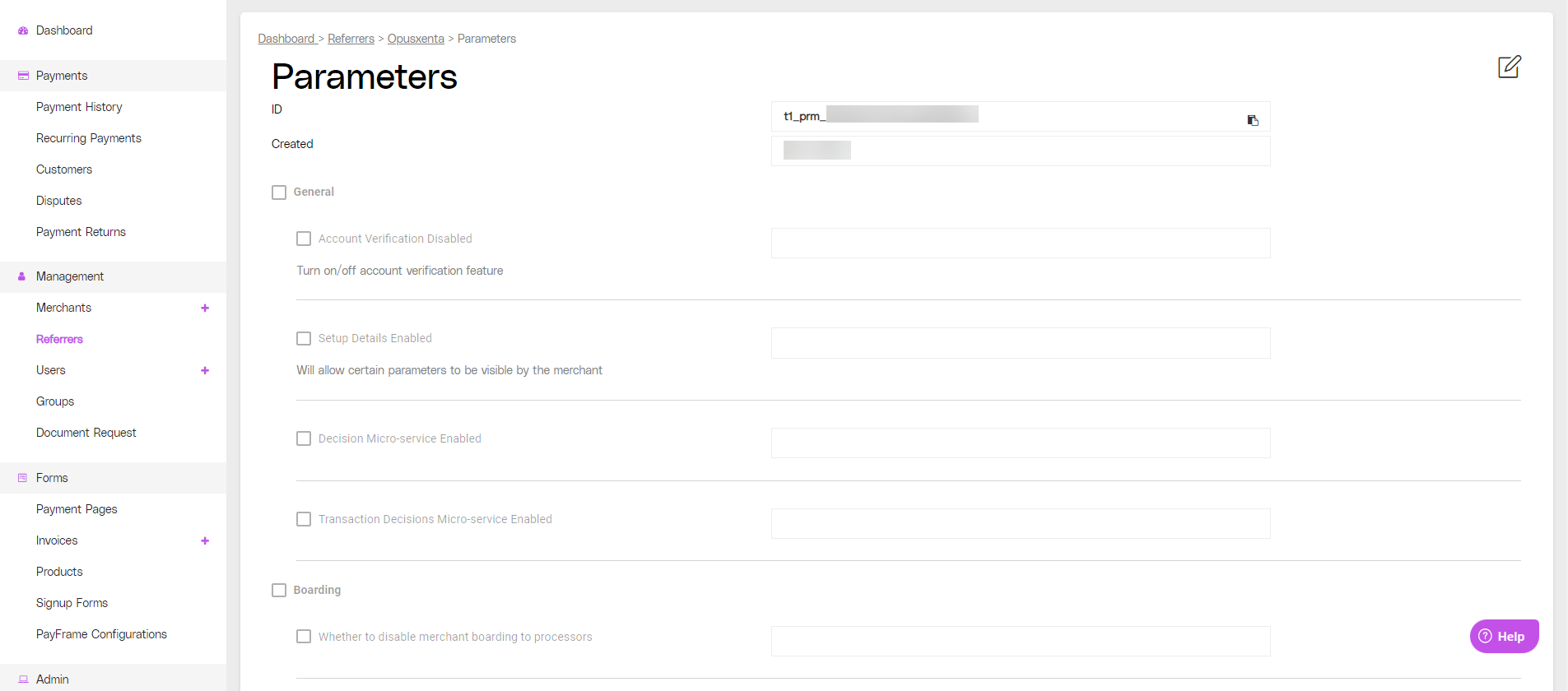

Partial view of the Parameters page showing the first ‘General’ category, followed by others.

Parameters Features

Parameter ID

The parameter ID will be automatically assigned to a new Parameter configuration you create. This can be copied by clicking the CLIPBOARD icon on the field containing the ‘ID’, and used in further API configurations or general recordkeeping.

Parameters Enablement Form

The EDIT icon on the upper right corner of the Parameters page allows you to quickly select the Parameters you want to enable and set their values.

To add one or more new parameters:

Click ADD PARAMETERS in the upper right corner of the Parameters panel to open the Parameters page.

Click the EDIT icon on the upper right corner of the page.

Toggle the checkbox for each category and parameter, then enter the desired value for each enabled parameter. (See list of available parameters below.)

Add the new parameter to the Referrer profile account by clicking the CHECKMARK icon.

Note: You can copy the parameter ID from the Parameters page for further API usage.

Parameter Category | Parameter | Description | Type |

|---|---|---|---|

General | Account Verification Disabled | Turn on/off account verification feature | Yes / No |

Setup Details Enabled | Will allow certain parameters to be visible by the merchant | Yes / No | |

Decision Micro-service Enabled | Turn on/off Risk Decision Micro-service. | Yes / No | |

Transaction Decisions Micro-service Enabled | Turn on/off Transaction Decision Micro-service. | Yes / No | |

Boarding | Whether to disable merchant boarding to processors | Turn on/off direct processor boarding from Merchants. | Yes / No |

Verify For Boarding Not Required | Require Bank Account Verification before merchant is boarded | Yes / No | |

Opt Blue Enabled | Boarded merchants should be acquired for Amex processing on the OptBlue program | Yes / No | |

Discover Acquired Enabled | Boarded merchants should be acquired for Discover processing | Yes / No | |

Minimum Boarding Ownership | Minimum percentage of ownership required for merchant boarding over all members | Percentage (%) | |

Boarding Exemptions Disabled | Allow Boarding Exemptions? | Yes / No | |

Auto Reboard Days | Number of days after merchant's created date to attempt a reboard on a not yet boarded merchant. The default setting is 60. | Number | |

Transactions | Minimum Total Transaction | Defines the minimum total amount for a single transaction to be processed | Number $ Amount |

Maximum Total Transaction | Defines the maximum total amount for a single transaction to be processed | Number $ Amount | |

Maximum Daily Transaction Total | Defines the maximum total volume the merchant can process per day | Number $ Amount | |

Maximum Daily Transaction Number | Defines the maximum number of transaction the merchant can process per day | Number $ Amount | |

Maximum Monthly Total | Defines the maximum total volume the merchant can process per month | Number $ Amount | |

Maximum Monthly Transaction Number | Defines the maximum number of transaction the merchant can process per month | Number | |

Maximum Subscription Failures | Maximum number of attempts allowed on subcription payment | Number | |

Amex Enabled | Allow Merchants to accept Amex cards | Yes / No | |

Discover Enabled | Allow Merchants to accept Discover cards | Yes / No | |

eCheck Enabled | Allow Merchants to accept eCheck | Yes / No | |

Auto Tax Exempt Enabled | Whether to assume a transaction is tax exempt if no tax is set for level II processing. | Yes / No | |

Apple Pay Enabled | Enabling Apple Pay will register the merchant with Apple. | Yes / No | |

Google Pay Enabled | Enabling Google Pay will register the merchant with Google. | Yes / No | |

Payout | Funding Enabled | Allow boarded merchants to make withdrawals | Yes / No |

Verify For Payout Not Required | Require Account Verification before merchant is allowed to make withdrawals | Yes / No | |

Minimum Payout Delay | Defines the number of days the payout will be delayed from date of request until it is processed | Number | |

Minimum First Payout Delay | Defines the number of days the first payout will be delayed from date of request until it is processed | Number | |

Payout Include Pending | Allow withdrawal if pending funds cover the negative balance | Yes / No | |

Include ACH Holidays and Weekends In Payout Delay | Allow withdrawals over ACH Holidays and Weekends to be delayed. | Yes / No | |

Minimum Available Funds | Minimum available funds an entity must have. If the entity is below this threshold credit payouts won't be processed and a debit will be processed to bring the entity's funds up to this threshold amount. | Number $ Amount | |

Minimum Debited Available Funds | Defines the threshold in the event an automated Debit disbursement is requested, due to the Minimum Available Funds falling below the defined setting, that the entities available funds will be brought back to. | Number $ Amount | |

Vendor Fees External | Whether to disburse vendor fees through the external Facilitator operating account. | Yes / No | |

Min eCheck Capture Delay | The number of days to delay funds processing for an eCheck sale. The default setting is 1. | Number | |

Minimum Payout Credit Total | Minimum credit allowed for payout | Number $ Amount | |

Minimum Payout Debit Total | Minimum debit allowed for payout | Number $ Amount | |

Maximum Payout Credit Total | Maximum credit allowed for payout | Number $ Amount | |

Maximum Payout Debit Total | Maximum debit allowed for payout | Number $ Amount | |

Minimum Debit Processing Delay | Minimum number of business days before a debit is processed and made available for funding. The default setting is 5. | Number | |

MC Instant Payouts Enabled | Enable Instant Payouts (Push To Card) for MasterCard transactions | Yes / No | |

MC Instant Payout Min | Minimum amount required for instant payout (Push To Card) for MasterCard transactions | Number $ Amount | |

MC Instant Payout Max | Maximum amount disbursed for instant payout (Push To Card) for MasterCard transactions | Number $ Amount | |

Visa Instant Payouts Enabled | Enable Instant Payouts (Push To Card) for Visa transactions | Yes / No | |

Visa Instant Payout Minimum | Minimum amount required for instant payout (Push To Card) for Visa transactions | Number $ Amount | |

Visa Instant Payout Maximum | Maximum amount disbursed for instant payout (Push To Card) for Visa transactions | Number $ Amount | |

Same Day Payouts Enabled | Enable Same Day Payouts | Yes / No | |

Same Day Payouts Daily Max | Maximum amounts allowed daily for same day payouts | Number $ Amount | |

Minimum Same Day Payout Credit Total | Minimum amount of credit transactions required to create a same day payout | Number $ Amount | |

Maximum Same Day Payout Credit Total | Maximum amount of credit transactions allowed for same day payout | Number $ Amount | |

Minimum Same Day Payout Debit Total | Minimum amount of debit transactions required to create a same day | Number $ Amount | |

Maximum Same Day Payout Debit Total | Maximum amount of debit transactions allowed for same day payout | Number $ Amount | |

Minimum Funds Payout Total | The minimum total debit allowed for payout. | Number $ Amount | |

Minimum Statement Debit Payout Delay | Set a delay on the payout related to a statement. Set to 0 if it should operate the same as credit payouts. | Number | |

Extra | Vendor Fees Enabled | Whether to allow vendors to create and assess fees on merchants | Yes / No |

Refund Releases Reserve | Whether to a refund processed for a reserved transaction will automatically release that reserve | Yes / No | |

Visa Misuse Settlement | The number of days before an Auth Misuse fee should be charged on a VISA txn that has not settled. The default setting is 10. | Number | |

Visa Misuse Card Present Reversal | The number of hours before an Auth Misuse fee should be charged on a card present VISA txn that wasn't reversed within the timeframe. The default setting is 24. | Number | |

Visa Misuse Card Not Present Reversal | The number of hours before an Auth Misuse fee should be charged on a card not present Visa txn that wasn't reversed within the timeframe. The default setting is 72. | Number | |

Visa Misuse Travel Auto Settlement | The number of days before an Auth Misuse fee should be charged on a VISA txn that has not settled. Applies only to merchants with a Travel & Entertainment MCC. | Number | |

MasterCard Misuse Settlement | The number of hours before an Auth Misuse fee should be charged on a card not present Mastercard txn that wasn't reversed within the timeframe. The default setting is 168. | Number | |

MasterCard Misuse Card Present Reversal | The number of hours before an Auth Misuse fee should be charged on a card present MasterCard txn that wasn't reversed within the timeframe. The default setting is 24. | Number | |

MasterCard Misuse Card Not Present Reversal | The number of hours before an Auth Misuse fee should be charged on a card not present MasterCard txn that wasn't reversed within the timeframe. The default setting is 72. | Number | |

MasterCard Misuse Travel Auto Reversal | The number of hours before an Auth Misuse fee should be charged on a MasterCard txn that wasn't reversed within the timeframe. Applies only to merchants with a Travel & Entertainment MCC. The default setting is 480. | Number | |

Account Updater Enabled | Whether payments will be checked for updates. Payments will be checked and updated if enabled | Yes / No | |

Account Updater Frequency | The frequency in number of days to check for payment updates. | Number | |

Update all tokens enabled | When Enabled, this parameter will send all tokens. When NOT enabled, this will only send subscription tokens (tokens associated with recurring billing schedules) | Yes / No | |

Debit Grace Period | This Parameter will set the number of days a merchant is allowed to carry a negative balance before creating a debit | Number | |

Negative Balance Limit | This is the maximum negative amount that we will allow for a merchant account. If the account balance goes negative in excess of this amount, the merchant will be instantly debited. | Number $ Amount | |

Negative Balance Email | Whether a notification email should be sent to this entity when their balance is negative. | Yes / No | |

Positive Balance Email | Whether a notification email should be sent to this entity when their balance has been restored from negative to positive. | Yes / No |

.png)