Add Parameters (F)

The Add Parameters page allows you to create additional parameters that control boarding, transactions, payouts, and other aspects of of your account.

Navigate to the Add Parameters page by following the steps below:

Step 1: Click Settings in the left hand navigation panel.

Step 2: Click Parameters in the Business Settings section of the page.

Step 3: Click the ADD PARAMETERS button in the top right hand corner of the Parameters page to open the Add Parameters page.

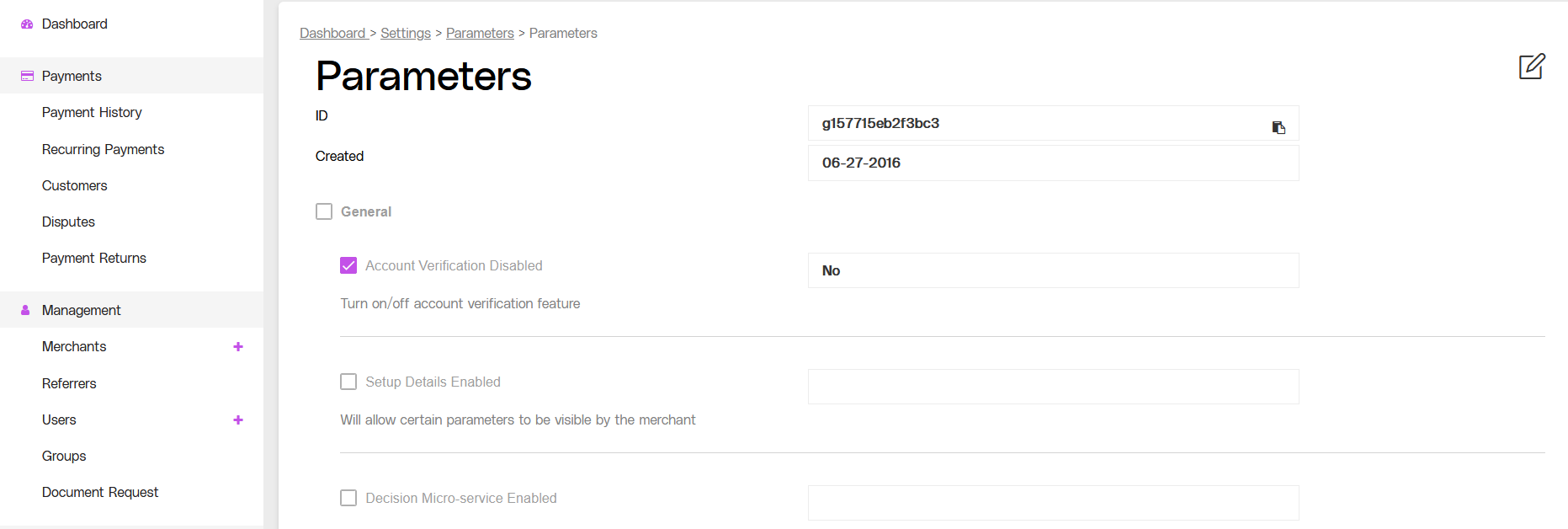

Partial view of the Add Parameters page, including the Parameter Settings Table.

Add Parameters Features

Parameter Settings Table

The Parameter Settings table contains a list of all parameters that are available in the portal, and allows you to edit individual parameters to customize your account settings.

Tip: To turn any parameters on or off, click the PENCIL icon in the top right hand corner of the page, then select or deselect any parameters by clicking the box to the left of the parameter name. Changes will be reflected in the table on the Parameters page.

Note: When you deselect a parameter, it will no longer be visible in the table on the Parameters page.

The Parameter Settings table contains the following information:

Parameter Settings Table Item Name | Description |

|---|---|

Account Verification Disabled | Indicates whether the account verification feature is enabled. |

Setup Details Enabled | Will allow certain parameters to be visible by the user. |

Decision Micro-Service Enabled | Indicates whether a micro-service process for decisions is enabled for the merchant. For more information about micro-services, see Microservice Projects. |

Whether to Disable Merchant Boarding to Processors | Allows you to disable merchant boarding to processors. |

Verify for Boarding Not Required | Requires bank account verification before a merchant is boarded. |

Opt Blue Enabled | Allows your users to accept Opt Blue payments. |

Discover Acquired Enabled | Allows your users to accept Discover payments. |

Minimum Boarding Ownership | The minimum percentage of ownership required for merchant onboarding over all members. |

Boarding Exemptions Disabled | Indicates whether certain API requirements to submit requests without all the required fields are disabled. |

Auto Reboard Days | The number of days after the merchant's onboarding request is submitted to attempt reboarding in the event that the account went through a manual review on the processor's end. This will resubmit the boarding request to attempt to board a merchant that has not yet boarded. The default setting is 60. |

Minimum Total Transaction | The minimum total dollar amount required for a single transaction to be processed. |

Maximum Total Transaction | The dollar amount of the maximum total amount for a single transaction to be processed through the merchant. |

Minimum Daily Total Transaction | The dollar amount of the minimum total volume that the merchant can process per day. |

Maximum Daily Transaction Total | The dollar amount of the maximum total volume that the merchant can process per day. |

Maximum Monthly Total | The dollar amount of the maximum total volume that the merchant can process per month. |

Maximum Monthly Transaction Number | The maximum number of transactions that the merchant can process per month. |

Maximum Subscription Failures | The maximum number of attempts allowed on a subscription payment. |

Amex Enabled | Allows your users to accept AMEX payments. |

eCheck Enabled | Allows your users to accept eCheck payments. |

Discover Enabled | Allows your users to accept Discover payments. |

MC 3DSecure Enabled | Allows the merchant to process Mastercard 3DSecure. |

Visa 3DSecure Enabled | Allows your users to process VISA 3DSecure. |

AMEX 3DSecure Enabled | Allows the merchant to process AMEX 3DSecure. |

DISCOVER 3DSecure Enabled | Allows the merchant to process Discover 3DSecure. |

Auto Tax Exempt Enabled | Indicates whether a transaction is assumed to be tax exempt if no tax is set for level II processing. |

Apple Pay Enabled | Allows your users to process Apple Pay payments. |

Google Pay Exempt Enabled | Allows the merchant to accept Google Pay payments. |

Funding Enabled | Allows your users to make withdrawals. |

Verify For Payout Not Required | Indicates whether account verification is required before a user is allowed to make withdrawals. |

Min Payout Delay | The minimum number of days the payout will be delayed from date of request until it is processed. |

Minimum First Payout Delay | The number of days the first payout will be delayed from date of request until it is processed. |

Payout Include Pending | Allows the merchant to withdraw a payout if pending funds cover the negative balance. |

Include ACH Holidays and Weekends In Payout Delay | Indicates whether to include ACH holidays and weekends in payout delay. |

Minimum Available Funds | The minimum available dollar amount of funds an entity must have. If the entity is below this threshold credit payouts won't be processed and a debit will be processed to bring the entity's funds up to this threshold amount. |

Minimum Debited Available Funds | Defines the threshold to which the entity's available funds will be returned. This event is triggered when an automated Debit disbursement is requested, due to the Minimum Available Funds falling below the defined setting. |

Vendor Fees External | Allows users to disburse vendor fees through an external facilitator operating account. |

Min eCheck Capture Delay | The number of days to delay funds processing for an eCheck sale. The default setting is 1. |

Minimum Payout Credit Total | The minimum credit dollar amount allowed for payout. |

Minimum Payout Debit Total | The minimum debit dollar amount allowed for payout. |

Maximum Payout Credit Total | The maximum credit dollar amount allowed for payout. |

Maximum Payout Debit Total | The maximum debit dollar amount allowed for payout. |

Minimum Debit Processing Delay | The minimum number of business days before a debit is processed and made available for funding. The default setting is 5. |

MC Instant Payouts Enabled | Indicates whether instant payouts (Push To Card) for Mastercard transactions are enabled. |

MC Instant Payouts Min | The minimum amount disbursed for instant payout (Push To Card) for Mastercard transactions, shown as a dollar amount. |

MC Instant Payout Max | The maximum amount disbursed for instant payout (Push To Card) for Mastercard transactions, shown as a dollar amount. |

VISA Instant Payouts Enabled | Indicates whether instant payouts (Push To Card) for VISA transactions are enabled. |

Visa Instant Payouts Min | The minimum amount disbursed for instant payout (Push To Card) for VISA transactions, shown as a dollar amount. |

VISA Instant Payout Maximum | The maximum amount disbursed for instant payout (Push To Card) for VISA transactions, shown as a dollar amount. |

Same Day Payouts Enabled | Indicates whether same day payouts is enabled. |

Same Day Payouts Min | The minimum dollar amount allowed daily for same day payouts. |

Same Day Payouts Daily Max | The maximum dollar amount allowed daily for same day payouts. |

Minimum Same Day Credit Payout Total | The minimum amount of credit transactions required to create a same day payout, shown as a dollar amount. |

Maximum Same Day Payout Credit Total | The maximum amount of credit transactions allowed for same day payout, shown as a dollar amount. |

Minimum Same Day Payout Debit Total | The minimum amount of debit transactions required to create a same day payout, shown as a dollar amount. |

Maximum Same Day Debit Payout Total | The maximum amount of debit transactions allowed for same day payout, shown as a dollar amount. |

Minimum Funds Payout Total | The minimum total debit allowed for payout, shown as a dollar amount. |

Minimum First Payout Delay | The number of days the first payout will be delayed from date of request until it is processed. |

Minimum Statement Debit Payout Delay | A delay that is set on the payout related to a statement. Set to 0 if it should operate the same as credit payouts. |

Vendor Fees Enabled | Allows vendors to create and assess fees on merchants or other users. |

Refund Releases Reserve | A refund processed for a reserved transaction will automatically release that reserve. |

Visa Misuse Settlement | The number of days before an auth misuse fee should be charged on a VISA transaction that has not settled. The default setting is 10. |

Visa Misuse Travel Auto Settlement | The number of days before an auth misuse fee should be charged on a VISA transaction that has not settled. Applies only to merchants with a Travel & Entertainment merchant category code (MCC). |

Visa Misuse Card Present Reversal | The number of hours before an auth misuse fee should be charged on a card-present VISA transaction that was not reversed within the timeframe. The default setting is 24. |

Visa Misuse Card Not Present Reversal | The number of hours before an Auth Misuse fee should be charged on a card-not-present VISA transaction that was not reversed within the timeframe. The default setting is 24. |

MasterCard Misuse Settlement | The number of hours before an Auth Misuse fee should be charged on a card-not-present Mastercard that wasn't reversed within the timeframe. The default setting is 168. |

MasterCard Misuse Card Present Reversal | The number of hours before an Auth Misuse fee should be charged on a card-present Mastercard transaction that wasn't reversed within the timeframe. The default setting is 24. |

MasterCard Misuse Card Not Present Reversal | The number of hours before an Auth Misuse fee should be charged on a card-not-present Mastercard transaction that wasn't reversed within the timeframe. The default setting is 72. |

MasterCard Misuse Travel Auto Reversal | The number of hours before an Auth Misuse fee should be charged on a Mastercard transaction that wasn't reversed within the timeframe. Applies only to merchants with a Travel & Entertainment merchant category code (MCC). The default setting is 480. |

Account Updater Enabled | Indicates whether payments will be checked for updates. Payments will be checked and updated if enabled. |

Account Updater Frequency | The frequency to check for payment updates. |

Update all tokens enabled | When enabled, this parameter will send all tokens. When NOT enabled, this will only send subscription tokens (tokens associated with recurring billing schedules). |

Related Pages:

Click the links below to access any of the following pages:

.png)