Refunds

Payrix supports refunding and voiding transactions using the Portal or the API. The pages below describe how to perform voids and refunds on the Payrix platform:

This page provides the following details about refunds and voids on Payrix:

Refunding & voiding transactions

Settled payments submitted to Payrix via the Portal or API can easily be reversed by issuing a partial or full refund. Refunds can be done directly in the Portal or by sending a POST request to the /txns endpoint of the API.

Payments submitted to Payrix via a semi-integrated or a directly integrated terminal device will only be imported to Payrix the next day. Therefore, until a transaction submitted on a terminal device is imported to Payrix it can only be refunded or voided directly on the device the payment was submitted on.

Once imported, terminal transactions can be refunded or voided in the Payrix Portal/API or directly on the device. A Merchant can check their Payment History in the Portal to see if a terminal transaction was imported yet.

In order for a payment to be refunded the transaction status must be captured or settled. In practical terms, a transaction can only be refunded once the payment was already batched out. Prior to batch out, when the payment has only been authorized and the transaction status is still approved, the payment can be (partially or fully) reversed by voiding or canceling the transaction.

The moment a payment is refunded the funds are deducted from the Merchant’s Payrix Available Balance and the process of returning the funds to the original cardholder begins.

If a Merchant does not have sufficient offsetting transactions or funds available in Payrix to cover a refund, their primary bank account on file may be debited to cover it.

Refund processing cycle & timeline

When a card payment or eCheck transaction is refunded, an authorization code is immediately created to successfully process the transaction refund amount in real-time.

Note: With the authorization of refunds, any refunds created in error will need to be adjusted with an offsetting sale transaction.

The related refund transaction will have a unique profile page in the Portal with a unique Transaction ID (TXN ID).

How long does it take for the customer to get their money back for a card payment refund?

When a refund is submitted, Payrix returns the relevant funds to the processing bank, but the timeline for the customer to actually see that money varies depending on how their bank processes refunds. Once a refund is settled the funds will usually hit the customer’s account within 3-7 business days (or 4-8 business days from when the refund is submitted by the Merchant) depending on the cardholder’s bank.

If a refund is showing as settled in Payrix but the customer hasn’t received their funds back yet, we suggest the cardholder reach out to their own bank before contacting Payrix Support.

eCheck refund cycle & timeline - When an eCheck payment is refunded, an entirely new ACH transaction is created within Payrix, completely separate from the original eCheck transaction. This new ACH transaction sends the relevant refund amount from the Merchant’s Payrix balance to the original customer’s bank account.

Because an eCheck refund is an entirely new and unique ACH transaction, the cycle and timeline match the normal eCheck payment process.

How long does it take for a customer to get their money back for an eCheck refund?

Generally, a customer will receive an eCheck refund 4-7 business days after it is submitted by the Merchant, but this varies depending on the customer’s bank.

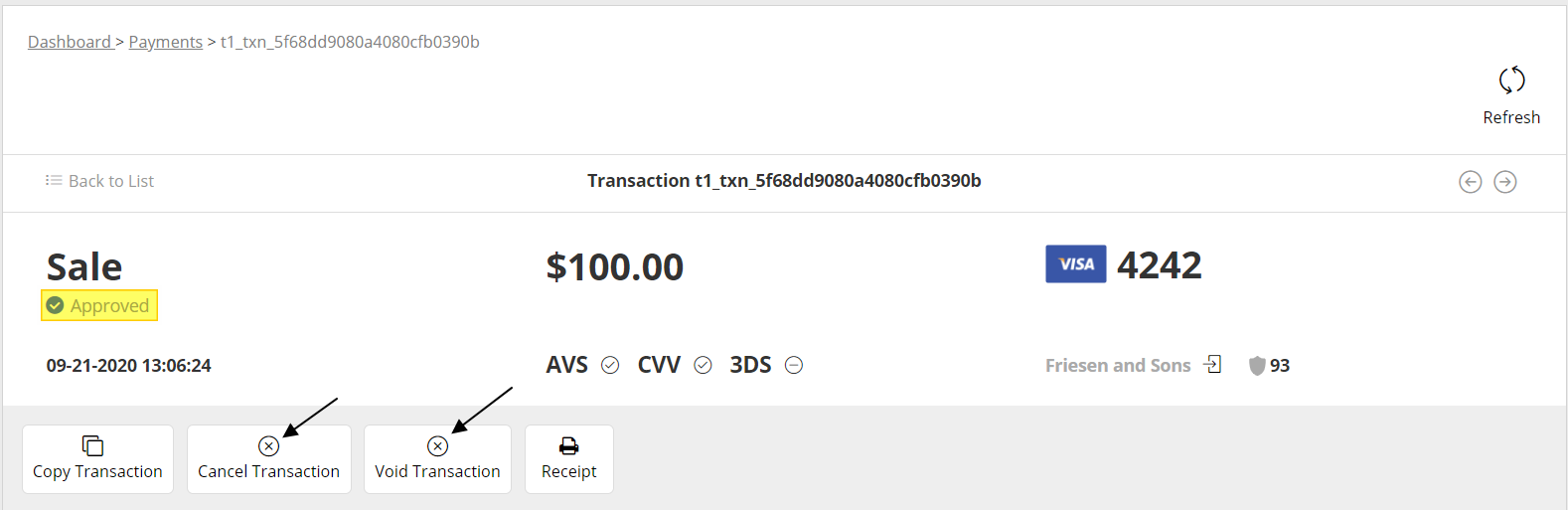

Voiding or canceling an approved transaction

When a card payment is initially submitted to Payrix the transaction status is approved until it is captured and settled as part of the Merchant’s daily batch. Because an approved transaction means the payment was authorized but it hasn’t been sent to the processing bank yet, and the funds are not available in the Merchant’s Payrix balance yet, these transactions cannot be refunded and must be voided or canceled in order to be reversed.

The difference between “voiding” and “canceling” an approved transaction

Voiding a transaction - When an approved transaction is voided the authorization code that was generated by the processing bank validating the payment when it was submitted is completely reversed. Therefore, if the Merchant decides to go through with the payment at a later date they will be required to re-submit the payment for authorization.

Canceling a transaction - Canceling a transaction removes that specific payment from the Merchant’s daily batch. However, the authorization code issued by the processing bank is still valid. In other words, if the Merchant decides to proceed with a canceled payment at a later date the original authorization code may still be valid, and the Merchant is only required to re-add the transaction to their next daily batch.

Furthermore, although the process for voiding and canceling a payment are similar when done in the Portal, there are some procedural differences when submitting a void or cancelation via the API.

Once a transaction is voided or canceled it will not be included in the Merchant’s daily batch, and no funds will be moved from the customer’s bank to the Merchant’s Payrix account.

.png)