Referrer Pre-Implementation

This resource outlines the Scope of Work (SOW) requirements pre-implementation.

All integrating Partners and software platforms work with the Payrix Pro Solution Engineers and Sales Team to create a Scope of Work (SOW) that describes what your integration will look like and the associated requirements across the Payrix Pro platform.

Table of Contents

Overview

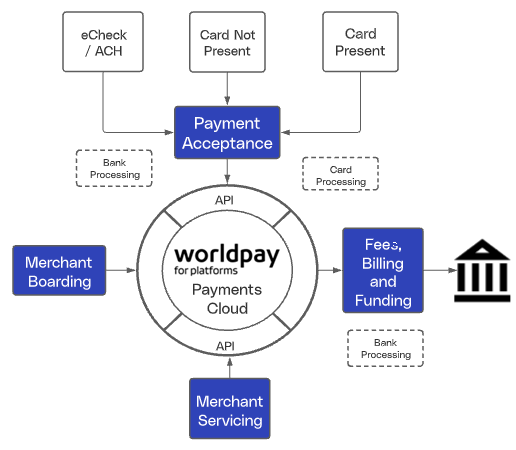

Building a Scope of Work with our Prospect Platforms involves a discussion about Features and Risk Considerations and collects data on how our Clients hope to leverage the Payrix Pro platform across the four Merchant Support features related to Payment Facilitation:

Fees, Billing, and Funding

Merchant Support

How Merchant Support features work together.

Ahead of your SOW call:

The following steps will be required ahead of creating the SOW:

Complete and submit the Payrix Pro Payments Cloud Partner Pre-Integration Form. (See Partner Pre-Integration Form below for assistance.) A Sales Representative will review your form and resend for your signature.

Sign the form and email it to the Implementations team at implementations@payrix.com.

Building a Scope of Work (SOW)

Partner Pre-Integration Discussion

We collect the information defined below to determine the best options for your business.

Click Next after all information is entered.

Question | Description | Notes |

|---|---|---|

Select a product line: | Pro | Completed by Worldpay for Platforms* |

Processor: | Worldpay or Fiserv | Completed by Worldpay for Platforms* |

Partner/PF’s Legal Name: | Partner Legal Name | Completed by Worldpay for Platforms* |

Partner/PF DBA(s) | Partner Business Name | Completed by Worldpay for Platforms* |

Partner URL: | Partner URL | Completed by Worldpay for Platforms* |

Payrix Pro Contacts

Question | Description |

|---|---|

Sales Executive: | Name of Sales Executive |

Implementations Manager: | Name of Implementations Manager |

Solutions Engineer: | Name of Solutions Engineer |

Relationship Manager: | Name of Assigned Relationship Manager |

Partner Contacts

Enter Partner Contact Full Name, Role, Email, and Phone.

Click Add Contact and then click Next.

Partner Overview

Use the table below for assistance in completing the Partner Overview.

Select your target markets.

Use the free form to let us know how your clients receive payments, and then click Next.

Question | Note |

|---|---|

What industries or verticals are your target markets? |

|

How do your clients take payments today? | Brief description explaining how your clients accept payments today. Example: “A practice management solution for dental offices that focuses on accepting payments through text to pay...” |

What are your goals and objectives for the user experience? | Examples:

|

Processing Capabilities

Select Yes or No to let us know whether you need Card Present Integration. If Yes, proceed to Card Present Integration. If No, proceed to Card Not Present.

Enter your Card Present Volume percentage.

Card Present - Use Case

Enter your Card Present - Use Case(s)

Card Present Integration

Select all applicable Card Present Capabilities.

Select Other Capabilities (if applicable).

Use the free form to enter any future processing needs and then click Next.

Card Not Present

Select all applicable Card Not Present Capabilities.

Select Other Capabilities (if applicable).

Use the free form to enter any future processing needs and then click Next.

Location of Referred Clients

Select the countries where your merchants are located.

Add the Percentage.

Click Add Country to add more than one country and then click Next.

Note

Payrix Pro is available in the United States, Canada, Australia, and New Zealand.

Partner Development Details

Select your development platform.

Use the free form to provide details about your current application and then click Next.

Question | Note |

|---|---|

Development language | For Example:

|

Development platform |

|

Will you be bringing on 3rd party developers? | Yes or No |

Do you have a payment technical resource on staff? | Yes or No |

Developer company name | Name |

Business registration number of the developer | BRN of developer |

Developer website | URL |

Merchant Onboarding Details

Boarding Integration

Select Yes or No to let us know whether you require a White Label.

If you selected Yes, select any applicable White Label Options.

Select your Merchant Boarding Integration. (See the Board Integration Options table for an explanation of each option.)

Click Next.

Boarding Integration Options | Note |

|---|---|

Merchants will be boarded through an online signup form. | |

The Full Boarding API is a managed service allowing you complete flexibility in the creation of new merchant locations. | |

Worldpay for Platforms will work with you to meet the necessary technical and underwriting requirements for bulk onboarding, simplifying the process of migrating your existing Merchants to Payrix Pro from another platform. |

Payment Workflow

Select all applicable Payment Workflow Options.

Use the free form to describe your ideal payment workflow and then click Next.

Question | Note | Payment Methods |

|---|---|---|

Please describe your ideal payment workflow: | Example:

|

Merchant Pricing Strategy

Select all applicable Merchant Pricing Options.

Select all applicable Merchant Pricing Types.

Use the free form to describe your go-to-market pricing strategy for payments and then click Next.

Fees

Question | Note | Resource |

|---|---|---|

How are fees assigned to the merchant? |

| Fees and Fee Models within Payrix Pro |

Can you describe how do bill fees to your clients? | Handled internally or via portal? |

Funding/Disbursement Integration

Select all applicable Merchant Funding Options.

Use the free form to describe how you currently fund and send payouts to your clients and then click Next.

Question | Note | Resource |

|---|---|---|

Funding is managed via the portal | ||

API Integration (payout schedule) | Funding managed by Partner/Client |

Risk and Compliance

Disputes and Chargebacks

Select all applicable Chargeback Management Options.

Use the free form to describe how you currently manage your chargeback process and then click Next.

Question | Note |

|---|---|

Disputes are managed via the portal | |

API Integration (chargeback documents/responses) | Disputes are managed by Partner/Client via API |

How do you manage the chargeback process? Please describe below? | Provide brief descriptions. Example: Chargeback are managed by a third party |

Current System

Question | Note |

|---|---|

Describe your current application and what it does: | For example:

|

Reporting Integration

Question | Note |

|---|---|

Reports are managed via the portal | |

Reports are pulled by Partner/Client via API | |

Scheduled reports created and generated by Payrix Pro | |

What type of reporting do you utilize today, and how do you provide reporting to your clients? | Example:

|

Data Migration (Token Transfer)

Question | Note |

|---|---|

Data Migration Required: | Yes or No |

Direct: | Partner owns tokens |

Current Processor: | Example:

|

Number of Tokens Under Migration: | How many tokens do we need to transfer |

Migration Target Date: | Expected date to complete token migration |

Outline Migration Plan: |

Partner/PF Launch Timeline

Projected Timeline

Question | Description |

|---|---|

Implementation Kick-Off Call: | Date of first implementation call |

Anticipated Integration Target Start Date: | When do you expect to start the integration |

Anticipated Integration Target Finish Date: | Expected date to finalize integration |

Target Beta Onboarded: | Estimated Target Beta Onboarded Date |

Target Full Launch: | Target full launch date |